In today’s rapidly evolving world, the digital age and the pandemic have caused significant shifts in the work environment across industries. In the realm of charter schools, understanding their financing options is crucial to their growth and success. Recently, we had the opportunity to meet with Brian Holman, a partner at MusickPeeler LLP, specializing in charter school finance. Our day was packed with insightful experiences, from exploring the changing landscape of MusickPeeler’s offices to diving deep into a Charter School Finance 101 presentation. In this blog post, we will share our key takeaways and what we learned about putting together a successful charter school facility finance structure.

The Changing Work Environment

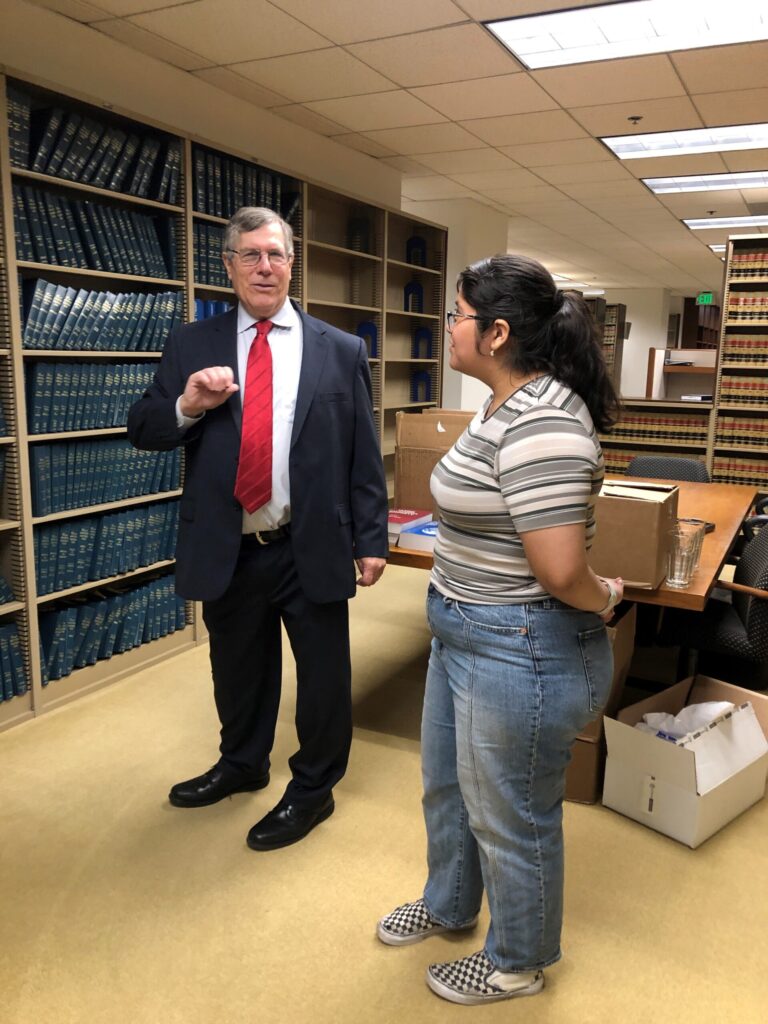

We kicked off our day with a tour of MusickPeeler LLP’s offices in downtown Los Angeles. Amidst the digital age and the pandemic, we observed the impact on their workspace. Numerous bookshelves stood nearly empty, a testament to how much information has migrated online. Nevertheless, the library still held a collection of valuable reference books, specifically focusing on various court cases.

Charter School Finance 101

Returning to PCSD’s offices, Brian Holman commenced his presentation on Charter School Finance 101. He began by discussing the different financing sources available to charter schools, ranging from donations to hard money loans. As nonprofits, charter schools have access to various types of donations, including contributions from individual donors and both private and public grants. We delved into an overview of financing sources like New Market Tax Credits, bond financings, bank and institutional loans, as well as federal and other government loans.

Building a Charter School Facility Finance Structure

One of the most valuable aspects of our day with Brian was gaining a clear understanding of the process of building a charter school facility finance structure. Through visual aids and insightful explanations, we were able to grasp the complexities involved. Brian concluded the presentation with some indispensable facility financing tips, emphasizing the importance of keeping one’s legal matters in order, involving legal counsel early in the process, thoroughly reading all agreements, and staying vigilant to avoid legal pitfalls.

Real-Life Example: A Charter School Facility Financing Deal

After lunch during which we learned more about Brian’s background and his journey into the legal field, we delved into an illustrative example of a charter school facility financing deal. We reviewed term sheets, loan agreements, and various loan documents, gaining valuable insights into how different parties collaborate throughout the process. It was fascinating to see how a charter school financing deal typically unfolds over 3-5 months, requiring careful attention to detail and collaboration among various stakeholders.

Understanding Corporate Organizations

To round out our enlightening day, we explored the different types of corporate organizations. Sole proprietorship, partnerships, corporations, limited liability companies (LLCs), and nonprofits all offer distinct advantages and disadvantages. Understanding these options can play a vital role in shaping a business’ structure.

Our day with Brian Holman at MusickPeeler LLP provided us with invaluable insights into charter school finance. Understanding the various financing sources available to charter schools and the process of building a successful charter school facility finance structure is essential for their growth and sustainability. We extend our sincere gratitude to Brian for sharing his expertise and making this day an enlightening and enriching experience.

The post Navigating Charter School Finance: Insights from a Day with Brian Holman at MusickPeeler appeared first on Pacific Charter School Development.